Money Motives: It’s Never Just About Money

Money Motives:

It’s Never Just About Money

What We'll Cover

We talk about money all the time. Budgets. Investments. Retirement plans. The numbers that show up in spreadsheets and linger in late-night thoughts. But money isn’t just numbers. It’s what those numbers stand for.

Safety. Freedom. Stability. Money is about more than math — it’s about being able to look the people you love in the eye and say, “You don’t have to worry — I’ve taken care of it.”

Most advice out there sticks to strategy. Save more. Spend less. Invest wisely. And yes, that’s part of it. But it misses the deeper truth.

Money is personal.

It’s shaped by our fears, our hopes, and the quiet promises we made to ourselves in uncertain moments. It’s the weight of wanting to provide, to protect, to prove we’re enough.

We’ve all felt it — that pull to chase something money seems to promise. Security. Respect. A sense of finally being okay.

But here’s what no one says out loud.

You can follow the plan, hit every goal, and still feel like something’s missing.

That’s not a budgeting issue.

That’s a motive issue.

What’s Driving You?

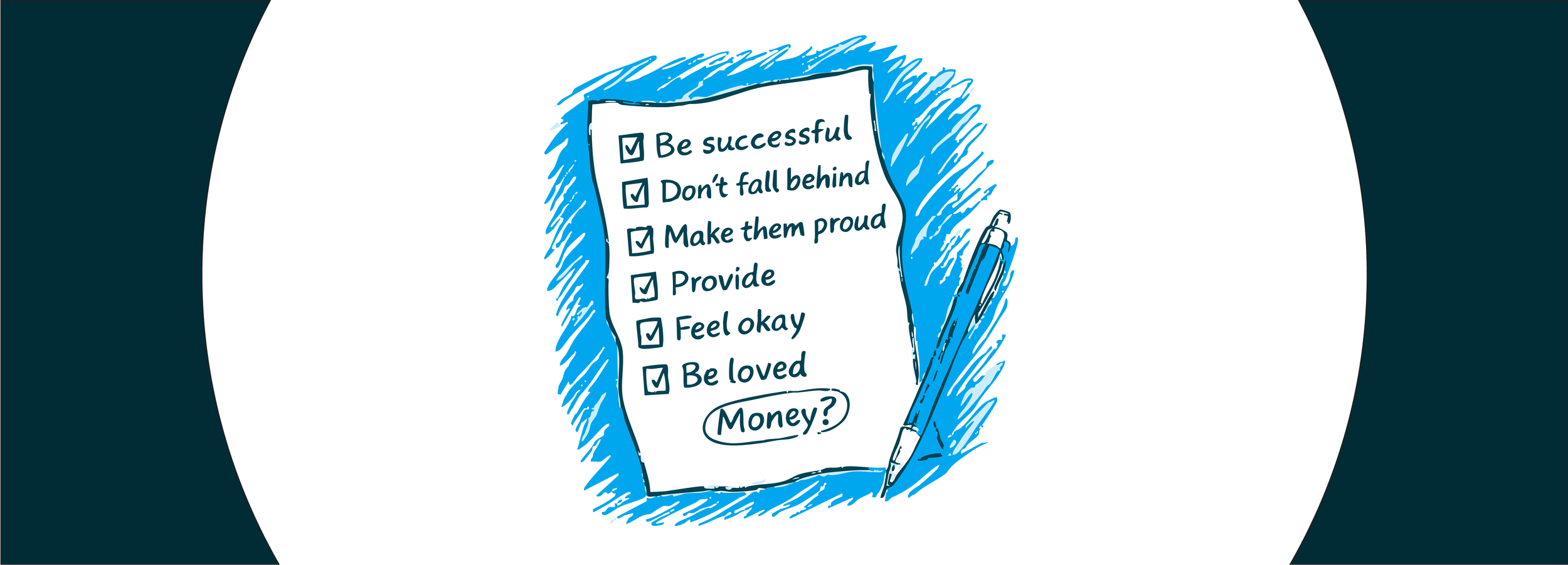

We see it every day. People come to us with accounts, goals, spreadsheets, and questions about what’s next. But underneath the planning, there’s almost always something else. A fear of falling behind. A pressure to keep up. A belief, often rooted years ago, that whispers — “If I don’t get this right, I’m on my own.”

These quiet motives shape everything. How we earn. How we spend. How we save, give, hold back, or overextend. Money becomes the way we measure our progress. Our safety. Sometimes even our worth. And if we’re not paying attention, it turns into the story we tell ourselves about whether we’re enough.

That’s where most financial advice falls short. It optimizes the numbers — but ignores the why.

At OLIO, we don’t just build plans. We ask better questions. The kind that shift the conversation — and everything after it:

What are you really working toward?

What does success actually feel like, not just look like?

Who are you trying to show up for?

What kind of life are you building — and is it yours, or someone else’s version of “right”?

These aren’t easy questions. They don’t fit neatly into a calculator. But they change everything. They move the focus from how much is enough to what is this all for?

Money as a Tool, Not a Scoreboard

Financial planning should do more than secure your future. It should anchor you in the present.

It should feel like a life that’s yours, not someone else’s idea of it.

Clarity over chaos.

Intention over pressure.

Agency over fear.

When you get clear on your motives, everything shifts. Money stops being a way to prove something and starts being a way to build something. A life where you can breathe. Where you can show up for the people you love. Where you can rest, give, and be fully present — without feeling like you’re falling behind.

We’ve seen it happen. When people let go of chasing status and start chasing substance, they find freedom. Not just in their accounts — but in their lives.

The plan becomes more than numbers. It becomes a reflection of who they are and what they value.

What Money Can and Can’t Do

Money can do incredible things. It can provide for your family, care for aging parents, create space for rest and generosity. It can buy time, ease pressure, and open doors.

But it can’t tell you who you are.

It can’t sit with you in the quiet moments.

It can’t fill the gaps that only meaning can.

And it won’t ever be enough if you’re using it to chase approval or fill a void.

That’s why the real work happens beneath the surface. It’s not just about growing wealth. It’s about growing a life — one that feels true, one that’s built on your values, not someone else’s expectations.

You’re already worth what you’re trying to prove.

Start From Enough

Trace your motives. Hold on to the ones that serve you. Let go of the ones that keep you stuck. Use money to build a life you love — not to prove something you already are.

You don’t have to earn your worth.

You’re already enough.

The numbers don’t define you.

They’re just part of the art you’re creating with your life.

At OLIO, we’re here to help you build that. Not just a portfolio, but a life that feels like yours — where clarity leads, fear fades, and you’re free to show up as you are.

Let’s start there.

Disclosures

The content on this blog is for informational and educational purposes only and should not be construed as personalized financial advice, tax advice, legal advice, an offer or solicitation to buy or sell any security, or a recommendation to pursue any specific investment strategy. The information provided is general in nature and may not be suitable for your individual circumstances.

Olio Financial Planning, LLC (“OLIO”) is a registered investment adviser with the United States Securities and Exchange Commission, domiciled in Virginia. Investment advisory services are only provided to investors who become OLIO clients under a written agreement. Past performance does not guarantee future results, and all investments involve risk, including the potential loss of principal.

Nothing contained herein should be interpreted as a guarantee of any specific outcome. Forward-looking statements or projections are based on assumptions and current market conditions, which are subject to change without notice. Actual results may differ materially.

You should consult your own financial, legal, tax, or other professional advisors before making any financial decisions. OLIO does not guarantee that the information presented is current, accurate, or complete, and assumes no responsibility for any errors or omissions.