Tariffs, Volatility, and Your Portfolio

Tariffs, Volatility, and Your Portfolio: Why We’re Staying the Course

WHAT WE'LL COVER

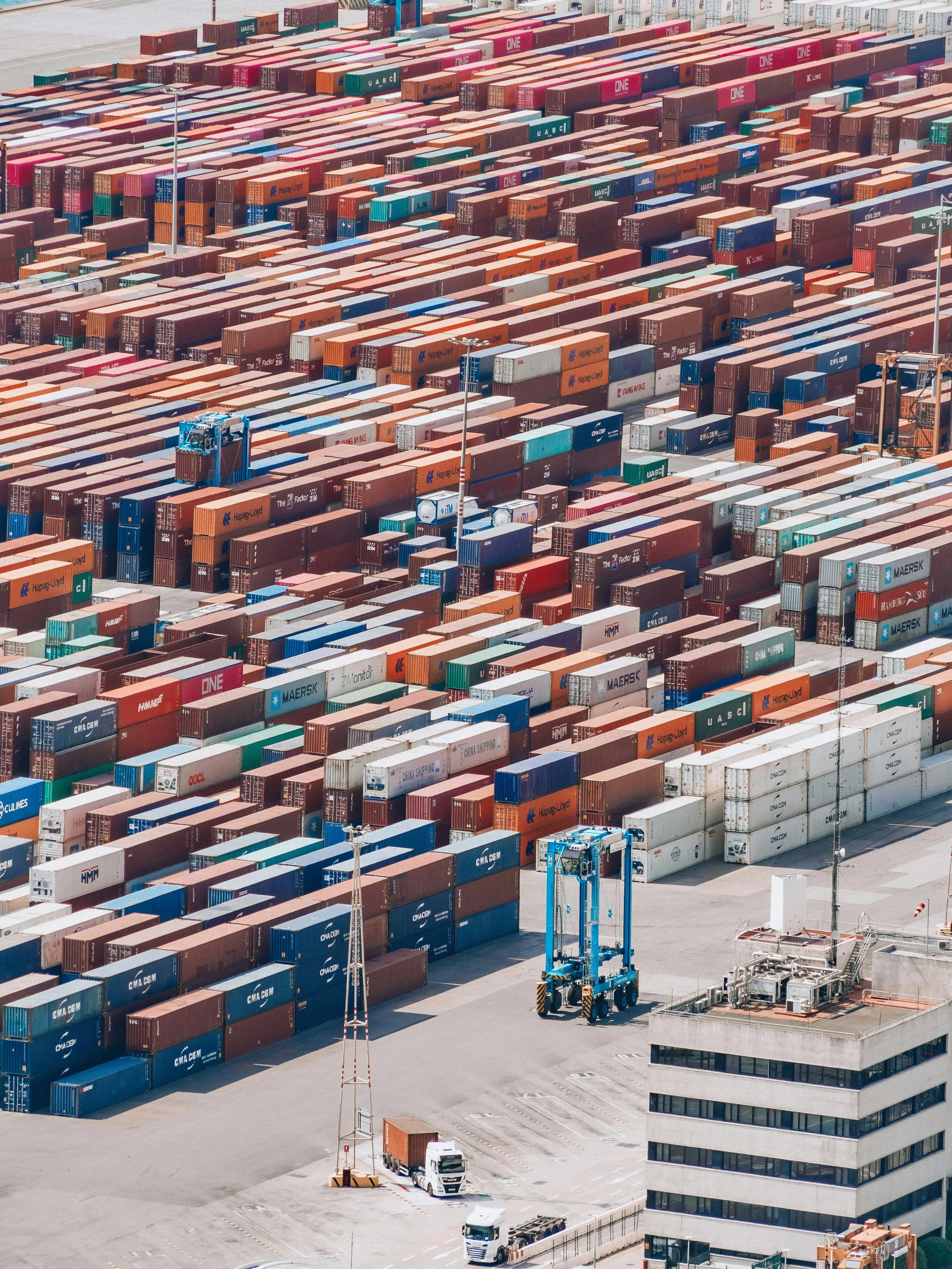

Last week, new trade tariffs were announced against imports from Canada, China, the EU, Japan, and Mexico—a day the administration even referred to as “Liberation Day.” In response, China tightened restrictions on U.S. tech and semiconductor investments, further rattling global markets.

It’s natural to feel uneasy when headlines like these hit. You might be wondering:

Should we be doing something different with my portfolio?

Here’s why the answer is no—and why staying disciplined is more important than ever.

At OLIO, we follow a consistent process, not the news cycle. Your portfolio is intentionally diversified across asset classes, industries, and geographies to reduce reliance on any single region or economy. In fact, even with countries like China, Canada, and Mexico in the news, several of these markets are still positive year to date, reinforcing the strength of global diversification.

What History Shows About Tariffs and Market Volatility

Markets fear uncertainty more than bad news. Once policy paths become clearer, markets tend to stabilize—and even rebound.

Past trade conflicts didn’t derail long-term growth. During the 2018–2019 tariff battles, markets were volatile but ultimately adapted as businesses adjusted.

Economies find a way. Tariffs can disrupt supply chains and raise short-term costs, but businesses, consumers, and central banks usually adjust over time.

Why Discipline Is Your Competitive Advantage

Market timing doesn’t work. Trying to jump in and out of markets based on the news often leads to worse outcomes.

Diversification helps by design. While no portfolio is immune to headlines, yours is built to spread risk across many sectors and regions.

Emotional investing is costly. Studies consistently show that selling during periods of uncertainty locks in losses and misses the eventual recovery.

How Tariffs Affect Inflation—and Why We Stay the Course

Historically, tariffs have had both inflationary and deflationary effects:

They raise prices (inflationary) because tariffs add costs to goods.

They slow demand (deflationary) because higher prices can curb consumer spending.

When these effects collide, they can sometimes lead to “stagflation”—a rare environment where prices rise while economic growth slows. While stagflation isn’t guaranteed now, heightened volatility is likely. That’s why our advice remains clear: Stay committed to your plan.

Looking back to the 1970s—a period marked by stagflation—investors who stayed consistent and kept investing month after month saw meaningful long-term gains, even during tough markets.

For example, someone who invested $100 per month from 1973 to 1978 earned an annualized return of 7.28%, compared to just 1.20% for the market as a whole.

Consistent investing through volatility works because it allows you to buy more shares at lower prices, turning short-term fear into long-term opportunity.

What You Can Do Right Now

Stay Invested. Your portfolio is built for resilience. No sudden moves needed.

Consider Cash for Stability. A strong emergency fund can help cover short-term needs without touching your investments.

Stick to Your Long-Term Plan. Temporary turbulence doesn’t change the course we’ve mapped out together.

The future is always uncertain. What separates successful investors isn’t predicting the next headline—it’s staying disciplined when uncertainty rises.

You’re prepared. We’re with you. And we’re staying the course.

Markets move fast. Wisdom doesn’t. Let others chase the noise—your edge is staying steady while the world spins.

Disclosures

The content on this blog is for informational and educational purposes only and should not be construed as personalized financial advice, tax advice, legal advice, an offer or solicitation to buy or sell any security, or a recommendation to pursue any specific investment strategy. The information provided is general in nature and may not be suitable for your individual circumstances.

Olio Financial Planning, LLC (“OLIO”) is a registered investment adviser with the United States Securities and Exchange Commission, domiciled in Virginia. Investment advisory services are only provided to investors who become OLIO clients under a written agreement. Past performance does not guarantee future results, and all investments involve risk, including the potential loss of principal.

Nothing contained herein should be interpreted as a guarantee of any specific outcome. Forward-looking statements or projections are based on assumptions and current market conditions, which are subject to change without notice. Actual results may differ materially.

You should consult your own financial, legal, tax, or other professional advisors before making any financial decisions. OLIO does not guarantee that the information presented is current, accurate, or complete, and assumes no responsibility for any errors or omissions.