4Q25 Quarterly Market Review

Quarterly Market Review

The fourth quarter of 2025 ended a year in which markets did what they often do best. They rose while most investors waited for a reason to panic.

Despite political noise, policy debates, and plenty of “this time is different” commentary, global stocks finished higher. Bonds added stability rather than stress. That was a welcome change from recent years.

The key lesson was clear. Markets don’t wait for certainty. They rarely reward those who insist on it. Wise investors understand that volatility is the price of entry. Once again, the wall of worry turned out to be more of a ladder than a barrier.

What We'll Cover

Key Takeaways

Markets finished 2025 with strong gains, even as volatility, policy shifts, and economic concerns persisted throughout the year.

Federal Reserve rate cuts helped support markets as inflation cooled and growth moderated.

Bonds delivered positive returns and resumed their role as a stabilizing part of portfolios.

International stocks led returns, marking a notable change after several years of U.S. dominance.

What the Headlines Don’t Show

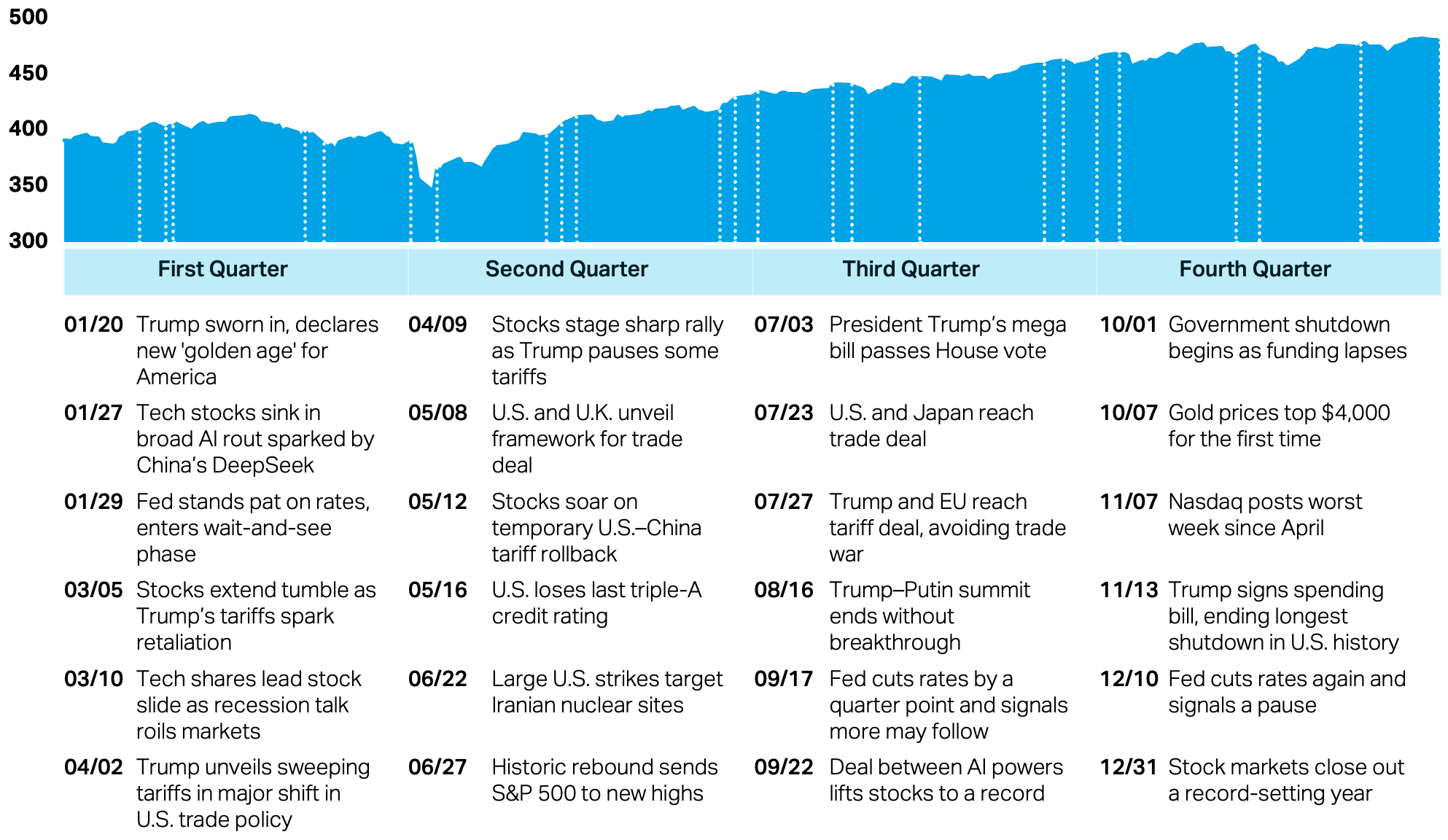

MSCI All Country World Index with selected headlines from 2025

These headlines are not offered to explain market returns. Instead, they serve as a reminder that investors should view daily events from a long-term perspective and avoid making investment decisions based solely on the news.

Past performance is not a guarantee of future results.

In USD. MSCI All Country World Index, net dividends.

MSCI data © MSCI 2025, all rights reserved.

Indices are not available for direct investment; therefore, their performance does not reflect the expenses associated with the management of an actual portfolio.

Headlines are sourced from various publicly available news outlets and are provided for context, not to explain the market's behavior.

How Markets Performed

Returns as of December 31, 2025

Details

Progress Through the Noise

The broader takeaway from 2025 is simple. Markets advanced even as the backdrop felt unsettled and uneven.

Three Years of Gains, Zero Years of Calm

U.S. stocks closed their third straight year of solid gains. That looks smooth on paper until you remember how bumpy the experience actually was. Pullbacks and volatility aren’t malfunctions. It’s part of how markets work.

Market leadership broadened somewhat, while some longtime highfliers took a breather, and anyone hoping for a calm, drama-free rally was disappointed.

The U.S. Isn’t the Whole Story

If 2025 reinforced anything, it’s that ignoring markets overseas can be costly. International developed and emerging market stocks outpaced U.S. stocks, supported by currency tailwinds, valuation differences, and broader participation.

This wasn’t a one-country wonder. Performance was spread across multiple regions and sectors. Investors with global exposure benefited, while home-biased portfolios lagged and asked uncomfortable questions afterward. Diversification performed its role quietly without seeking credit.

Bonds Did What Bonds Are Supposed to Do

Bonds weren’t the headline, but they served their purpose. They added stability and a steadier source of return, which helped more conservative investors feel less dependent on stocks doing all the work. That stability mattered, and that’s what they’re there for.

The Economy Refused to Cooperate with Recession Forecasts

Economic data followed a familiar pattern. Growth slowed, inflation cooled in some areas, and the labor market softened but held together. Consumer spending proved more resilient than many expected, even as confidence readings fluctuated.

It wasn’t a boom, but it also wasn't the downturn many forecasters predicted. The economy continued to muddle through, and markets treated that as investable. Commentators may dislike uncertainty, but markets have shown they can operate within it.

Taxes, Policy, and the Long Game

The so-called One Big Beautiful Bill generated headlines, but the immediate market impact was far less dramatic than the coverage suggested. Tax and policy changes matter, though their effects tend to play out over years rather than quarters.

Real influence shows up through incentives, planning decisions, and longer-term business behavior. Investors who tried to trade on legislative news often found themselves reacting twice with little to show for it. Coordinating tax strategies and financial planning remains far more effective than headline-driven portfolio changes.

Discipline Still Wins

By the end of the year, the lesson was familiar but still important. Those “better entry points” appeared only after prices had already moved higher.

Consistent positioning proved more effective than tactical shifts. Diversification, rebalancing, and patience once again supported long-term outcomes, even as markets moved through periods of uncertainty.

The individual investor should act consistently as an investor and not as a speculator.

Looking Ahead to 2026

The outlook for 2026 feels familiar. There are real opportunities ahead, along with plenty of uncertainty. Inflation has eased from its peaks but remains above long-term targets. Growth appears slower, though still positive. Interest rates are lower than they were a year ago, and policy decisions will continue to influence markets.

Rather than trying to predict exactly how the year will unfold, we’re focused on principles that tend to hold up over time.

Owning a mix of investments matters because different parts of the market don’t move together.

Trying to jump in and out of markets is difficult, especially when conditions feel uncertain.

Following a thoughtful long-term plan matters more than trying to perfectly time every short-term decision.

Rebalancing along the way helps manage risk and ensures portfolios don’t drift too far from their intended design.

Being invested has historically mattered more than waiting on the sidelines.

Final Thoughts

Every market cycle gives investors reasons to second-guess. 2025 had plenty, and 2026 will bring more.

What stood out wasn’t a lack of uncertainty, but how consistently markets rewarded those who stayed steady. Investors who continued investing and focused on long-term fundamentals were generally better positioned. Those who waited for a crystal ball likely missed the move.

We continue to hear calls to step aside, hold cash, or re-enter when conditions feel safer. In practice, those decisions are far more difficult than they sound. By the time uncertainty fades, markets have usually already adjusted. Comfort and opportunity rarely arrive at the same time.

Our approach hasn’t changed. The ups and downs are part of investing. Preparing for it and continuing to invest through it is how long-term progress happens. Staying invested matters. Letting time and compounding do their work matters most.

Markets will remain noisy. Progress often happens quietly.

Disclosures

All expressions of opinion reflect the judgment of the author(s) as of the date of publication and are subject to change. The content on this blog is for informational and educational purposes only and should not be construed as personalized financial advice, tax advice, legal advice, an offer or solicitation to buy or sell any security, or a recommendation to pursue any specific investment strategy. The information provided is general in nature and may not be suitable for your individual circumstances.

Olio Financial Planning, LLC (“OLIO”) is a registered investment adviser with the United States Securities and Exchange Commission, domiciled in Virginia. Investment advisory services are only provided to investors who become OLIO clients under a written agreement. Past performance does not guarantee future results, and all investments involve risk, including the potential loss of principal.

Nothing contained herein should be interpreted as a guarantee of any specific outcome. Forward-looking statements or projections are based on assumptions and current market conditions, which are subject to change without notice. Actual results may differ materially.

You should consult your own financial, legal, tax, or other professional advisors before making any financial decisions. OLIO does not guarantee that the information presented is current, accurate, or complete, and assumes no responsibility for any errors or omissions.